Use the following information to answer the question(s) below.

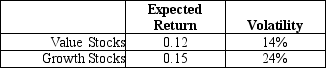

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

A) .53.

B) .58.

C) .61.

D) .79.

Correct Answer:

Verified

Q94: Use the following information to answer the

Q95: Use the following information to answer the

Q96: Use the following information to answer the

Q97: Use the following information to answer the

Q98: Which of the following is NOT an

Q100: Use the following information to answer the

Q101: Use the information for the question(s)below.

Tom's portfolio

Q102: Which of the following statements is FALSE?

A)The

Q103: Use the information for the question(s)below.

Tom's portfolio

Q104: Which of the following statements is FALSE?

A)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents