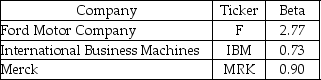

Use the following information to answer the question(s) below.

-If the market risk premium is 6% and the risk-free rate is 4%,then the expected return of investing in Merck is closest to:

A) 5.4%.

B) 9.4%.

C) 10.0%.

D) 10.4%.

Correct Answer:

Verified

Q81: Which of the following statements is FALSE?

A)Because

Q82: Suppose that KAN's beta is 1.5.If the

Q83: Use the information for the question(s)below.

Suppose that

Q84: Use the following information to answer the

Q85: Use the information for the question(s)below.

Suppose that

Q87: Suppose that Gold Digger's beta is -0.8.If

Q88: Which of the following statements is FALSE?

A)Beta

Q89: Use the following information to answer the

Q90: Use the information for the question(s)below.

Suppose the

Q91: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents