Use the information for the question(s)below.

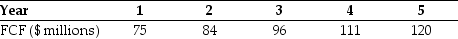

You expect DM Corporation to generate the following free cash flows over the next five years:  Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

Beginning with year six,you estimate that DM's free cash flows will grow at 6% per year and that DM's weighted average cost of capital is 15%.

-If DM has $500 million of debt and 14 million shares of stock outstanding,then what is the price per share for DM Corporation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Rearden Metals expects to have earnings this

Q60: If you want to value a firm

Q61: Use the following information to answer the

Q62: Which of the following statements is FALSE?

A)Even

Q63: Use the information for the question(s)below.

You expect

Q65: Which of the following statements is FALSE?

A)Because

Q66: Use the following information to answer the

Q67: Use the following information to answer the

Q68: Use the information for the question(s)below.

Defenestration Industries

Q69: Which of the following statements is FALSE?

A)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents