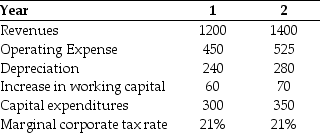

Use the information for the question(s) below.

Shepard Industries is evaluating a proposal to expand its current distribution facilities.Management has projected the project will produce the following cash flows for the first two years (in millions) .

-The depreciation tax shield for the Shepard Industries project in year one is closest to:

A) $59 million.

B) $168 million.

C) $96 million.

D) $50 million.

Correct Answer:

Verified

Q47: Use the information for the question(s)below.

The Sisyphean

Q48: Use the information for the question(s)below.

Epiphany Industries

Q49: Use the information for the question(s)below.

Temporary Housing

Q50: Use the information for the question(s)below.

Shepard Industries

Q51: Use the information for the question(s)below.

Shepard Industries

Q53: Luther Industries has outstanding tax loss carryforwards

Q54: Use the information for the question(s)below.

The Sisyphean

Q55: Use the information for the question(s)below.

Shepard Industries

Q56: You are considering investing $600,000 in a

Q57: Bubba Ho-Tep Company reported net income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents