Use the following information to answer the question(s) below.

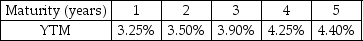

Suppose the current zero-coupon yield curve for risk-free bonds is as follows:

-The price per $100 face value of a three-year,zero-coupon,risk-free bond is closest to:

A) $93.80.

B) $90.06.

C) $89.16.

D) $86.39.

Correct Answer:

Verified

Q12: Which of the following statements is FALSE?

A)One

Q13: Which of the following statements is FALSE?

A)The

Q14: Consider a zero-coupon bond with a $1000

Q15: Suppose a ten-year bond with semiannual coupons

Q16: Which of the following statements is FALSE?

A)The

Q18: Which of the following formulas is INCORRECT?

A)Yield

Q19: Which of the following statements is FALSE?

A)Zero-coupon

Q20: Consider a zero-coupon bond with 20 years

Q21: Use the information for the question(s)below.

The Sisyphean

Q22: What is the relationship between a bond's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents