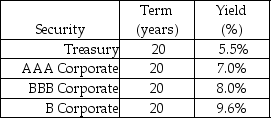

Use the following information to answer the question(s) below.

-Wyatt Oil is contemplating issuing a 20-year bond with semiannual coupons,a coupon rate of 7%,and a face value of $1000.Wyatt Oil believes it can get a BBB rating from Standard and Poor's for this bond issue.If Wyatt Oil is successful in getting a BBB rating,then the issue price for these bonds would be closest to:

A) $800.

B) $891.

C) $901.

D) $1000.

Correct Answer:

Verified

Q76: Which of the following statements is FALSE?

A)By

Q77: Which of the following statements is FALSE?

A)Given

Q78: A corporate bond which receives a BBB

Q79: Use the table for the question(s)below.

Consider the

Q80: The price of a five-year,zero-coupon,default-free security with

Q82: Which of the following statements is FALSE?

A)Because

Q83: Use the information for the question(s)below.

Luther Industries

Q84: Which of the following statements is FALSE?

A)Bond

Q85: Use the information for the question(s)below.

Luther Industries

Q86: Use the information for the question(s)below.

Luther Industries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents