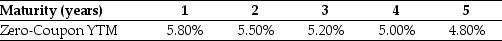

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 5 (the forward rate quoted today for an investment that begins in four years and matures in five years) is closest to:

A) 4.0%.

B) 3.8%.

C) 4.8%.

D) 4.2%.

Correct Answer:

Verified

Q98: Taggart Transcontinental has issued at par a

Q99: Wyatt Oil is contemplating issuing a 20-year

Q100: Use the following information to answer the

Q101: Sovereign debt is:

A)debt issued by national governments.

B)debt

Q102: Which of the following equations is INCORRECT?

A)Expected

Q104: An exception to the key difference between

Q105: Which of the following statements is FALSE?

A)The

Q106: Use the table for the question(s)below.

Consider the

Q107: Use the table for the question(s)below.

Consider the

Q108: A key difference between sovereign default and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents