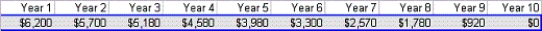

Estimate the mean and standard deviation of the NPV of this project.Assume that cash flows are discounted at a rate of 10% per year.Now assume that the project has an abandonment option.At the end of each year you can abandon the project for the values given below:  For example,suppose that year 1 cash flow is $400.Then,at the end of year 1,you expect cash flow for each remaining year to be $400.This has an NPV of less than $6200,so you should abandon the project and collect $6200 at the end of year 1.Estimate the mean and standard deviation of the project with the abandonment option.How much would you pay for the abandonment option? (Hint: You can abandon a project at most once.Thus,in year 5,for example,you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned.Also,once you abandon the project,the actual cash flows for future years will 0.So,the future cash flows after abandonment should disappear.)

For example,suppose that year 1 cash flow is $400.Then,at the end of year 1,you expect cash flow for each remaining year to be $400.This has an NPV of less than $6200,so you should abandon the project and collect $6200 at the end of year 1.Estimate the mean and standard deviation of the project with the abandonment option.How much would you pay for the abandonment option? (Hint: You can abandon a project at most once.Thus,in year 5,for example,you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned.Also,once you abandon the project,the actual cash flows for future years will 0.So,the future cash flows after abandonment should disappear.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Which of the following is typically not

Q39: Which function is often required in simulations

Q40: In a manufacturing model,we might simulate the

Q41: Estimate the mean and standard deviation of

Q42: After a year,what will the market share

Q44: In investment models,a useful approach for generating

Q45: Consider a device that requires two batteries

Q46: Suppose we compare the difference between the

Q47: The amount of variability of a financial

Q48: If the warranty period were reduced to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents