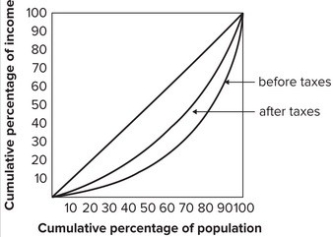

The graph shows that:

A) the effect of taxes is to make the distribution of income less equal.

B) the effect of taxes is to make the distribution of income more equal.

C) before-tax income and after-tax income are both equally distributed.

D) taxes are highly regressive.

Correct Answer:

Verified

Q90: Public assistance programs:

A) are not means-tested and

Q91: Unemployment compensation is available to:

A) anyone who

Q92: According to the text, the most important

Q93: Our ability to manage Social Security as

Q94: SNAP provides:

A) financial assistance to needy families

Q95: Because the poor tend to use public

Q96: The program that redistributes the most money

Q97: When former president Obama promised to raise

Q98: When a tax is proportional, the average

Q100: One of the major complaints about state

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents