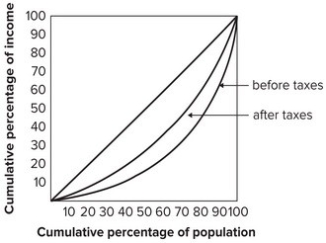

Refer to the graph shown.  A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A possible explanation for the difference between the distribution of income before taxes and the distribution of income after taxes shown in the graph is that the tax system:

A) is regressive.

B) is proportional.

C) is progressive.

D) does not affect income inequality.

Correct Answer:

Verified

Q77: Bertrand de Juvenal's views on income distribution

Q78: If redistribution is a public bad, rather

Q79: For U.S. workers in tradable sectors such

Q80: The democratic system of one person/one vote:

A)

Q81: When taxation is proportional, the tax rate

Q83: Federal tax and expenditure programs:

A) are somewhat

Q84: The U.S. income tax is a:

A) progressive

Q85: When the top marginal tax rate fell

Q86: Which of the following Lorenz curves is

Q87: Social Security is:

A) a pension program that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents