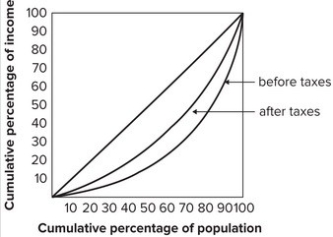

The graph shows that:

A) the effect of taxes is to make the distribution of income less equal.

B) the effect of taxes is to make the distribution of income more equal.

C) before-tax income and after-tax income are both equally distributed.

D) taxes are highly regressive.

Correct Answer:

Verified

Q8: One way to look at inequality is

Q10: Give three reasons why an equal distribution

Q15: Describe the difference between share distribution of

Q17: Explain the difference between wealth and income.

Q19: What is a Lorenz curve?

Q81: When taxation is proportional, the tax rate

Q88: Which program has been very successful in

Q93: Our ability to manage Social Security as

Q94: SNAP provides:

A) financial assistance to needy families

Q95: Because the poor tend to use public

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents