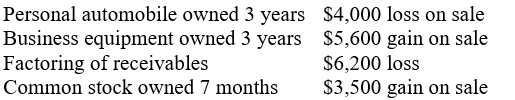

An individual taxpayer has the following property transactions during the current year:

How do these transactions affect the individual's AGI?

A) AGI is increased by $2,900

B) AGI is decreased by $1,100

C) AGI is increased by $9,100

D) AGI is decreased by $2,900

Correct Answer:

Verified

Q61: William purchased his personal residence in 2011

Q62: Justin, who is single, sells his principal

Q63: Which of the following statements concerning the

Q64: Bennett, who is single, owns all of

Q65: Tina is single and one of the

Q67: Liam used his auto 70 percent for

Q68: Shawn, a single taxpayer, sold the house

Q69: Which of the following is not a

Q70: Sophia, a single taxpayer, is one of

Q71: Clem and Chloe, a married couple, sell

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents