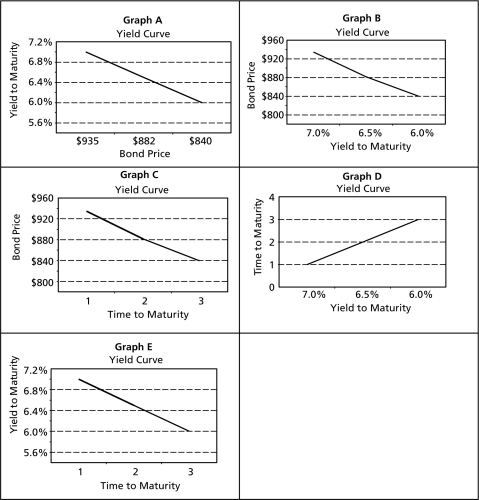

Which of the graphs below is the correct depiction of the yield curve given the data on the three zero coupon bonds in the table below? Zero Coupon Bond Prices and Yields

A) Graph A

B) Graph B

C) Graph C

D) Graph D

E) Graph E

Correct Answer:

Verified

Q5: To raise funds for Gravina Island Bridge,the

Q6: Crystal Clear Inc.is undertaking a new investment

Q7: The 5-year T-Note yields 6% and the

Q8: At the latest auction,1-year T-Bills were priced

Q9: The table, below, shows market prices

Q12: The nominal rate of interest is 6%

Q14: The prices of three zero-coupon bonds

Q15: The prices of a number of

Q16: Consider a $1,000 face value zero coupon

Q17: How much should an investor pay for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents