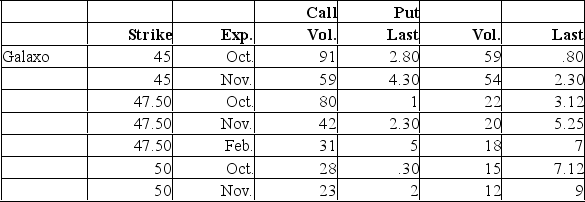

Underlying stock price: 45.80  You want to purchase one October 45 call contract on Glaxo stock. The option contract will cost you _______________. (Ignore transactions costs.)

You want to purchase one October 45 call contract on Glaxo stock. The option contract will cost you _______________. (Ignore transactions costs.)

A) $30.00

B) $100.00

C) $280.00

D) $430.00

E) $900.00

Correct Answer:

Verified

Q42: You sold a put contract on EDF

Q173: You wrote three call option contracts with

Q174: You sold (wrote) three TXA call option

Q175: Underlying stock price: 45.80 Q176: You currently own a one-year call option Q177: The current market value of the assets Q179: You sold five put options on Wexmeyer Q180: Martha B's has total assets of $1,750. Q181: Underlying stock price: 25 Q182: The current market value of the assets![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents