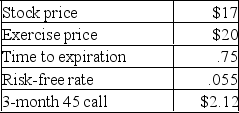

What is the value of a 9-month put with a strike price of $20 given the Black-Scholes Option Pricing Model and the following information?

A) $3.25

B) $3.67

C) $3.88

D) $4.03

E) $4.31

Correct Answer:

Verified

Q163: Today, you are buying a one-year call

Q164: Underlying stock price: 45.80 Q165: The assets of Jensen Explorers are currently Q166: Today, you are buying a one-year call Q167: What is the value of a 3-month Q169: ABC stock is currently priced at $31.42 Q170: The common stock of New Horizon Homes Q171: You own a call option on Beaker Q172: Ted's Welding Shop has a pure discount Q173: You wrote three call option contracts with![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents