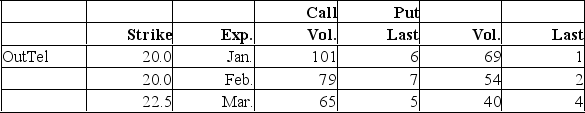

Underlying stock price: 25  You want to purchase one February call option contract on the stock. The contract with a $20 exercise price will cost you ________. (Ignore transactions costs.)

You want to purchase one February call option contract on the stock. The contract with a $20 exercise price will cost you ________. (Ignore transactions costs.)

A) $100

B) $200

C) $500

D) $600

E) $700

Correct Answer:

Verified

Q57: You wrote ten call option contracts on

Q185: The bonds of VDM, Inc. are convertible

Q186: Underlying stock price: 45.80 Q187: Underlying stock price: 25 Q188: The current value of a firm is Q189: You currently own a one-year call option Q191: The delta of a call option on Q192: Underlying stock price: 45.80 Q193: John and Randy form a company with Q195: Shares of a stock are currently priced Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()