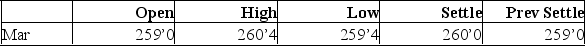

You are the purchasing agent for a cookie company. You anticipate that your firm will need 15,000 bushels of oats in March. You decide to hedge your position today and did so at the closing price of the day. Assume that the actual market price turns out to be 261´0 on the day you actually buy the oats. How much more would you have spent or saved if you had not taken the hedge position?

Oats - 5,000 bu.: cents per bu.

A) Spent $15 more.

B) Spent $150 more.

C) Saved $15.

D) Saved $150.

E) Saved $1,500.

Correct Answer:

Verified

Q226: A futures contract can best be defined

Q227: An option contract can best be defined

Q228: A swap contract can best be defined

Q229: A call option can best be defined

Q230: Basis risk can best be defined as:

A)

Q232: A firm has a risk profile that

Q233: You grow wheat and figure that you

Q234: A plot showing the gains and losses

Q235: A financial asset that represents a claim

Q236: If a firm creates an interest rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents