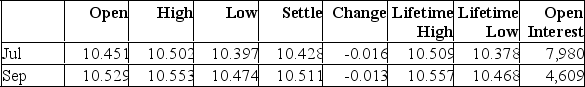

You are a jewelry maker. Every September you purchase 15,000 troy ounces of silver. Today, you hedged your position at what turned out to be the highest price for the day. Assume that the actual price per troy ounce of silver is 10.361 at the time you make the purchase in September. You would have _____ if you had not hedged your position.

Silver - 5,000 troy oz.; $ per troy oz.

A) saved $2,250

B) saved $2,880

C) spent another $450

D) spent another $2,250

E) spent another $2,880

Correct Answer:

Verified

Q238: You are the buyer for a cereal

Q239: Cross-hedging can best be defined as:

A) A

Q240: A forward contract on wheat:

A) Obligates the

Q241: The financial manager of AB Conners, Inc.

Q242: The goal of financial risk management as

Q244: The Smith Co. can borrow money at

Q245: A(n) _ contract is a legally binding

Q246: A risk profile is a plot showing

Q247: Which of the following is NOT generally

Q248: Which one of the following methods of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents