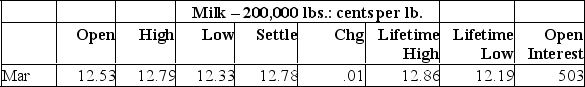

You are the purchasing agent for a candy company. You anticipate that your firm will need 400,000 pounds of milk in March. You decide to hedge your position today and did so at the closing price of the day. Assume that the actual market price turns out to be 12.74 on the day you actually buy the milk. How much more would you have spent or saved if you had not taken the hedge position?

A) You could have saved $160.

B) You spent an extra $160.

C) You could have saved $840.

D) You spent an extra $840.

E) You spent an extra $1,640.

Correct Answer:

Verified

Q267: You purchased a May American call option

Q268: Provide a suitable definition of cross-hedging.

Q269: Provide a suitable definition of risk profile.

Q270: You purchased a May American put option

Q271: Suppose a farmer has 100,000 bushels of

Q273: You sold (wrote) a May American call

Q274: If you have a _ rate loan

Q275: What is the goal of financial risk

Q276: Provide a suitable definition of futures contract.

Q277: A study of derivatives use by Canadian

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents