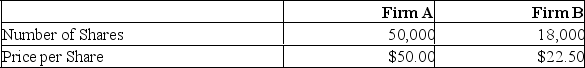

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the NPV of acquiring Firm B?

What is the NPV of acquiring Firm B?

A) The NPV is negative

B) $94,588

C) $102,120

D) $118,156

E) $162,015

Correct Answer:

Verified

Q65: It has been suggested that the reason

Q66: Firm A can acquire firm B for

Q67: By Staggering the election of board members,

Q68: An argument against using an acquisition by

Q69: Neither acquiring firm A nor target firm

Q71: Firm S is planning on merging with

Q72: Calipers, Inc. is acquiring Johnson Warehouse for

Q73: All else equal, the cost of an

Q74: Downing's Boats has agreed to be acquired

Q75: The Sandwich Shoppe has 1,600 shares outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents