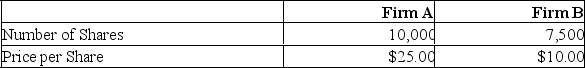

Both firms are 100% equity-financed. Firm A can acquire firm B for $82,500 in the form of either cash or stock. The synergy value of the deal is $12,500.  What will the price per share be of the post-merger firm if payment is made in stock?

What will the price per share be of the post-merger firm if payment is made in stock?

A) $25.00

B) $25.38

C) $25.50

D) $25.76

E) $27.30

Correct Answer:

Verified

Q49: Firm A is acquiring Firm B for

Q78: Firm A is being acquired by Firm

Q93: Firm Q is being acquired by Firm

Q95: Bob's Bait Shop has 1,200 shares outstanding

Q97: Lefty's and Sonny's are all-equity firms. Lefty's

Q99: DEF stockholders are paid the current market

Q100: Guido's and Elrod's are all-equity firms. Guido's

Q101: Palace Inns is acquiring Sequoia for $38,000

Q102: Firm A can acquire firm B for

Q103: Firm A is being acquired by Firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents