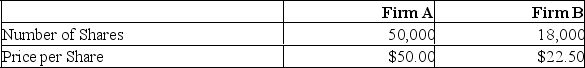

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What are the synergistic benefits that arise from the acquisition of Firm B?

What are the synergistic benefits that arise from the acquisition of Firm B?

A) $138,000

B) $250,000

C) $405,000

D) $655,000

E) $920,000

Correct Answer:

Verified

Q71: Firm X is being acquired by Firm

Q77: Principal,Inc. is acquiring Secondary Companies for $29,000

Q100: Guido's and Elrod's are all-equity firms. Guido's

Q101: Palace Inns is acquiring Sequoia for $38,000

Q102: Firm A can acquire firm B for

Q103: Firm A is being acquired by Firm

Q106: Both firms are 100% equity-financed. Firm A

Q107: Firm B is willing to be acquired

Q108: Both firms are 100% equity-financed. Firm A

Q109: Firm A is being acquired by Firm

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents