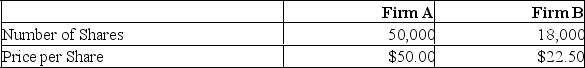

Neither acquiring firm A nor target firm B has any debt. The incremental value of the proposed acquisition is estimated to be $250,000. Firm B is willing to be acquired for $30 per share in cash.  What is the merger premium per share in this case?

What is the merger premium per share in this case?

A) $0

B) $2.50

C) $7.50

D) $10.00

E) $30.00

Correct Answer:

Verified

Q132: Q133: Both firms are 100% equity-financed. Firm A Q134: Neither acquiring firm A nor target firm Q135: Firm B is willing to be acquired Q136: Jackson & Jackson (J&J) has agreed to Q138: Firm A is being acquired by Firm Q139: Cavalier Enterprises has agreed to be acquired Q140: Firm B is willing to be acquired Q141: DEF stockholders are paid the current market Q142: The Sligo Co. is planning on merging![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents