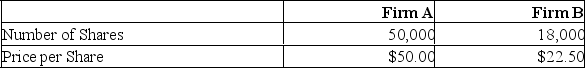

Suppose you have the following information concerning an acquiring firm (A) and a target firm (B) . Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock.  What is the merger premium per share in this case?

What is the merger premium per share in this case?

A) $0

B) $2.50

C) $7.50

D) $10.00

E) $30.00

Correct Answer:

Verified

Q50: Rudy's,Inc. and Blackstone,Inc. are all-equity firms. Rudy's

Q122: Firms A and B are competitors. Both

Q123: DEF stockholders are paid the current market

Q124: Weston Bakery and Early's Bakery are all-equity

Q125: Both firms are 100% equity-financed. Firm A

Q127: Firm A is acquiring Firm B for

Q128: Firm B is willing to be acquired

Q129: Firm X is being acquired by Firm

Q130: Firm B is willing to be acquired

Q131: Suppose you have the following information concerning

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents