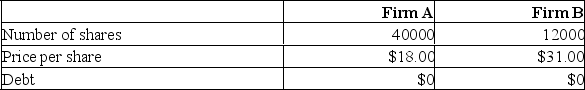

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  How many shares of stock will firm AB have if the merger is an all-stock deal?

How many shares of stock will firm AB have if the merger is an all-stock deal?

A) 52,000

B) 60,667

C) 62,333

D) 62,667

E) 63,333

Correct Answer:

Verified

Q73: Goodday & Sons is being acquired by

Q153: Gillison Markets is being acquired by Bakersfield

Q154: DEF stockholders are paid the current market

Q155: Both firms are 100% equity-financed. Firm A

Q156: Midway Supply is planning on merging with

Q157: Discount Motor Parts has agreed to merge

Q159: Hallaman's Auto is being acquired by Macy's

Q160: Both firms are 100% equity-financed. Firm A

Q162: Kojack Film needs silver to make photographic

Q163: An amalgamation can best be defined as:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents