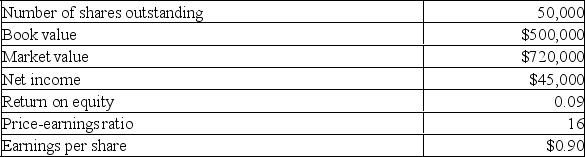

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of financing the project. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $10.00

B) $10.37

C) $12.07

D) $14.68

E) $15.04

Correct Answer:

Verified

Q61: You decide to raise $2 million in

Q62: The Jenkins Co. is considering a project

Q63: A Calgary firm is considering a new

Q64: The Purple Nickel is seeking to raise

Q65: Wexford Industries offers 60,000 shares of common

Q67: An Edmonton firm has 800,000 shares outstanding

Q68: The stock of Byron Enterprises is currently

Q69: You decide to take your company public

Q70: Allied Corporation offers 40,000 shares of common

Q71: Glasses, Etc. is offering 100,000 shares of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents