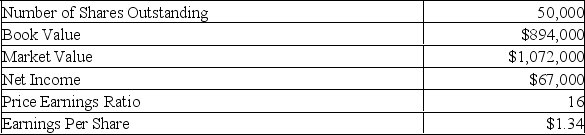

Bartow Industrial is reviewing a new proposal which will require $360,000 of new fixed assets. The net present value of the project is $84,000. The price-earnings ratio of the project equals that of the existing firm. What will the new book value per share be after the project is implemented given the following current information on the firm?

A) $16.22

B) $18.77

C) $22.47

D) $23.61

E) $25.08

Correct Answer:

Verified

Q86: Uptown Rentals is offering 5,000 shares of

Q87: Calculate the subscription price given the following

Q88: A Kinston firm faces direct costs of

Q89: A company has decided to raise $20

Q90: The stock of Violets 4 U is

Q92: You decide to take your company public

Q93: The Wisdom Company has 1.5 million shares

Q94: Nester, Inc. has decided to raise $3

Q95: Aki Corporation currently has 70,000 shares outstanding

Q96: Hamilton, Inc. is issuing a rights offering

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents