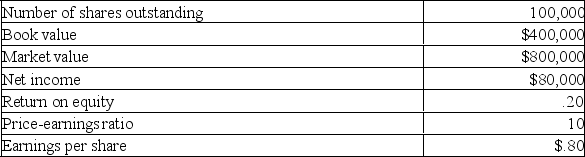

A Toronto firm is considering a new project which requires the purchase of $250,000 of new equipment. The net present value of the project is $100,000. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $6.86

B) $7.94

C) $8.00

D) $8.08

E) $8.76

Correct Answer:

Verified

Q103: You own 5 % or 4,000 shares

Q104: Jack's Camping Equipment needs $30 million to

Q105: You own 10 % or 5,000 shares

Q106: Winning Sportswear wants to raise $3 million

Q107: Stephen owns 5,000 shares of ABNC stock.

Q109: Lakeside Industrial has decided to sell an

Q110: Jonston Tree Farm is selling 1,500 shares

Q111: Jenna owns 600 shares of stock in

Q112: Grizzley Bare, Inc. is offering 1,500 shares

Q113: You own 8 % or 36,000 shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents