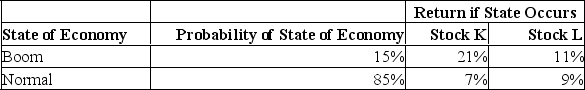

What is the portfolio variance if 60% is invested in stock K and 40% is invested in stock L?

A) .00000

B) .00091

C) .00108

D) .00172

E) .00249

Correct Answer:

Verified

Q76: Market risk premium is needed to estimate

Q77: Portfolio betas will always be greater than

Q78: Slope of the SML = [E(RA) +

Q79: Standard deviation is needed to estimate the

Q80: If the total risk of firm X

Q82: The Capital Asset Pricing Model (CAPM) assumes

Q83: The market rate of return is 12%

Q84: You have a $1,000 portfolio which is

Q85: The Capital Asset Pricing Model (CAPM) assumes

Q86: Using the Capital Asset Pricing Model (CAPM),

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents