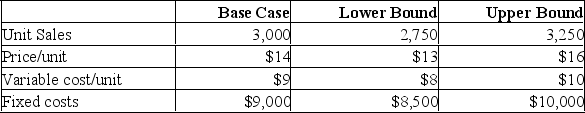

A project requires an initial investment of $10,000, straight-line depreciable to zero over four years. The discount rate is 10%. Your tax bracket is 34% and you receive a tax credit for negative earnings in the year in which the loss occurs. Additional information for variables with forecast error are shown below.  What is the worst case NPV for the project?

What is the worst case NPV for the project?

A) -$11,594

B) -$10,967

C) -$4,423

D) -$2,327

E) +$3,677

Correct Answer:

Verified

Q134: At a production level of 5,600 units

Q135: The Quick Producers Co. is analyzing a

Q136: TD, Inc. is analyzing a new project.

Q137: The company is conducting a sensitivity analysis

Q138: The company conducts a sensitivity analysis using

Q140: BASIC INFORMATION: A three-year project will cost

Q141: A firm has fixed costs of $30,000

Q142: A project has an accounting break-even point

Q143: Matrix, Inc. currently has sales of $39,600,

Q144: What is the contribution margin for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents