Magellen Industries is analyzing a new project. The data they have gathered to date is as follows:  Initial requirement for equipment: $120,000

Initial requirement for equipment: $120,000

Depreciation: Straight-line to zero over the four-year life of the project with no salvage value.

Required rate of return: 15%

Marginal tax rate: 35%

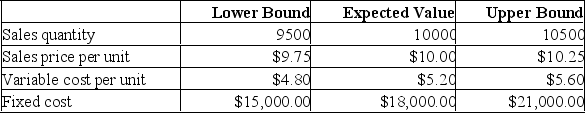

The project is operating at the ________ under the base-case scenario.

A) Most profitable level.

B) Accounting break-even level.

C) Point where the IRR is equal to -100%.

D) Financial break-even point.

E) Cash break-even level.

Correct Answer:

Verified

Q6: Which one of the following is most

Q318: If a firm's fixed costs are exactly

Q319: Jupiter Industries manufacturers fishing poles specifically designed

Q320: The situation that exists when a firm

Q321: _ analysis combines _ analysis and _

Q322: The base case values used in scenario

Q324: Fast-food restaurants occasionally offer new menu items

Q326: The financial break-even point is described as

Q327: Assume that you graph the changes in

Q328: The degree of operating leverage is defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents