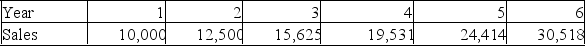

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 6. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What is the operating cash flow during year 5 of the project?

What is the operating cash flow during year 5 of the project?

A) $66,429

B) $107,426

C) $117,406

D) $162,132

E) $189,025

Correct Answer:

Verified

Q78: Land can be depreciated for tax purposes.

Q79: The EAC method for evaluating projects applies

Q80: A company is evaluating the replacement of

Q81: Katie's Cafe is considering the addition of

Q82: Ski World is considering a new product

Q84: A project requires the purchase of machinery

Q85: A company has projected sales of $542,000,

Q86: The managers of PonchoParts, Inc. plan to

Q87: Judson Industries is considering a new project.

Q88: The equipment required for a four year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents