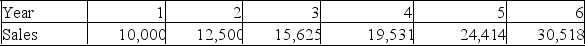

A project requires an initial fixed asset investment of $600,000, which will be depreciated straight-line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the end of the project is estimated to be $50,001. Projected sales volume for each year of the project is shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4 through 1. A $30,000 initial investment in net working capital is required, with additional investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on investment of 12%.  What are the additions to NWC during year 4 of the project?

What are the additions to NWC during year 4 of the project?

A) Use $4,125

B) Use $7,323

C) Use $65,917

D) Recover $5,123

E) Recover $16,342

Correct Answer:

Verified

Q324: Which one of the following statements is

Q325: Which of the following is the best

Q326: Toni's Tools is comparing machines to determine

Q327: Which of the following is the best

Q328: The _ approach for calculating project operating

Q330: The depreciation tax shield is defined as

Q331: The operating cash flow of a firm

Q332: When computing a bid price, the net

Q333: If the corporate tax rate were to

Q334: The bottom-up approach to computing the operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents