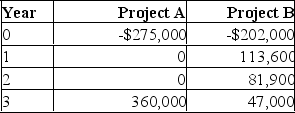

You are considering two mutually exclusive projects with the following cash flows. Which project(s) should you accept if the discount rate is 7 %? What if the discount rate is 10 %?

A) Accept project A as it always has the higher NPV.

B) Accept project B as it always has the higher NPV.

C) Accept A at 7 % and B at 10 %.

D) Accept B at 7 % and A at 10 %.

E) Accept A at 7 % and neither at 10 %.

Correct Answer:

Verified

Q211: Which capital investment evaluation technique is described

Q212: You would like to invest in the

Q213: Under the payback method of analysis:

A) The

Q214: You are considering the following two mutually

Q215: Elderkin& Martin is considering an investment which

Q217: You are considering the following two mutually

Q218: You are considering the following two mutually

Q219: A firm seeks to accept projects with

Q220: Sal is considering a project that costs

Q221: An investment's average net income divided by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents