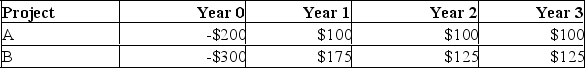

If the discount rate is 14% and the firm has limited funds, which of the following is true?

If the discount rate is 14% and the firm has limited funds, which of the following is true?

A) The PI of project A is less than 1.0.

B) The PI of project B is less than 1.0.

C) Based on the PI rule, project A is preferable.

D) Both projects would be rejected based on the PI rule.

E) The project with the smaller initial investment always has the higher PI.

Correct Answer:

Verified

Q250: You are considering the following two mutually

Q251: Assuming that straight line depreciation is used,

Q252: The present value of an investment's future

Q253: The discount rate that makes the net

Q254: The internal rate of return should:

A) Not

Q256: Use the following mutually exclusive investment cash

Q257: The essence of _ is determining whether

Q258: You are considering two mutually exclusive projects

Q259: Which of the following is considered to

Q260: You are considering two independent projects with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents