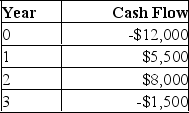

You are considering an investment with the following cash flows. If the required rate of return for this investment is 13.5 %, should you accept it based solely on the internal rate of return rule? Why or why not?

A) yes; because the IRR exceeds the required return

B) yes; because the IRR is a positive rate of return

C) no; because the IRR is less than the required return

D) no; because the IRR is a negative rate of return

E) You cannot apply the IRR rule in this case because there are multiple IRRs.

Correct Answer:

Verified

Q296: If a firm uses the _ as

Q297: The crossover point is defined as the

Q298: If you want to review a project

Q299: An NPV of zero implies that an

Q300: A project with an NPV of zero

Q302: The _ produces a ranking of all

Q303: A project should be accepted when the:

A)

Q304: The possibility that more than one discount

Q305: Two projects which each _ is an

Q306: The internal rate of return will tell

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents