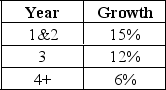

Moore Money Inc. just paid a dividend of $2. The required return on the stock is 15%. If it has the following expected dividend growth rates what should the stock sell for?

A) $22.45

B) $26.17

C) $27.79

D) $28.89

E) $29.68

Correct Answer:

Verified

Q149: Saskatchewan Steel, Ltd. and Alberta Copper, Inc.

Q150: Berkshire Homes recently paid $2.20 as an

Q151: Gen-Y corporation's current stock price is $50

Q152: XYZ Corporation's next dividend is expected to

Q153: XYZ Corporation's next dividend is expected to

Q155: Sedge Inc. has a 12% required rate

Q156: XYZ Corporation's next dividend is expected to

Q157: Nu Electronics is expecting a period of

Q158: Jim owns shares of Abco, Inc. preferred

Q159: Peterson Nurseries just paid a $3.20 annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents