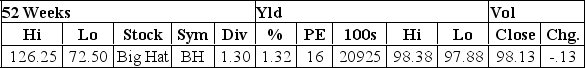

Assume the expected growth rate in dividends is 7%. Then the constant growth model suggests that the required return on Big Hat stock is:

Assume the expected growth rate in dividends is 7%. Then the constant growth model suggests that the required return on Big Hat stock is:

A) 7.4%

B) 7.9%

C) 8.0%

D) 8.4%

E) 9.8%

Correct Answer:

Verified

Q272: The current price of XYZ stock is

Q273: The preferred stock of the Pearson Institute

Q274: If a company has a current stock

Q275: If a company has a current stock

Q276: Bradley Broadcasting expects to pay dividends of

Q278: The preferred stock of Deep South Pies

Q279: CBC stock is expected to sell for

Q280: Jackson Supply has 2,500 shares of stock

Q281: An asset characterized by cash flows that

Q282: The dividend growth model:

A) Values a stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents