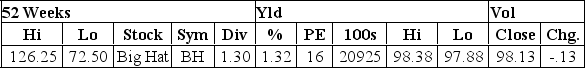

You believe that the required return on Big Hat stock is 12% and that the expected dividend growth rate is 10%, which is expected to remain constant for the foreseeable future. Is the stock currently overvalued, undervalued, or fairly priced?

You believe that the required return on Big Hat stock is 12% and that the expected dividend growth rate is 10%, which is expected to remain constant for the foreseeable future. Is the stock currently overvalued, undervalued, or fairly priced?

A) Overvalued.

B) Undervalued.

C) Fairly priced.

D) Cannot tell without more information.

E) Mispriced.

Correct Answer:

Verified

Q310: The total rate of return on a

Q311: Equity with differential voting rights and/or dividend

Q312: As illustrated using the dividend growth model,

Q313: The primary reason for creating dual or

Q314: The rate at which a stock's price

Q316: Next year's annual dividend divided by the

Q317: Equity without priority for dividends or in

Q318: A form of equity which receives preferential

Q319: Over the past four years, a company

Q320: The common stock of the Kenwith Co.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents