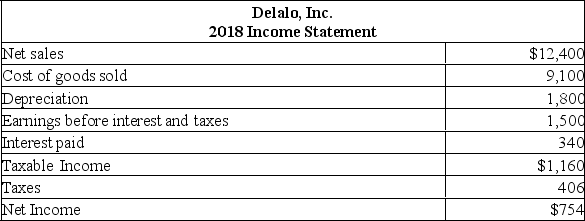

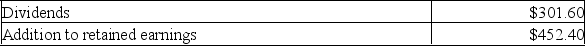

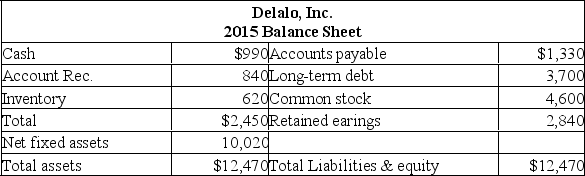

Assume that Delalo, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are constant. What is the projected increase in net fixed assets if sales are projected to increase by 11 percent?

Assume that Delalo, Inc. is operating at full capacity. Also assume that all costs, net working capital, and fixed assets vary directly with sales. The debt-equity ratio and the dividend payout ratio are constant. What is the projected increase in net fixed assets if sales are projected to increase by 11 percent?

A) $269.50

B) $506.00

C) $1,102.20

D) $1,371.70

E) $2,719.50

Correct Answer:

Verified

Q49: The following balance sheet and income statement

Q50: The sustainable growth rate excludes any kind

Q51: Total asset turnover is a determinant of

Q52: The sustainable growth rate includes a variable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents