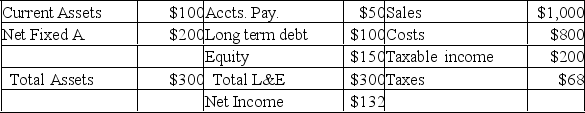

Assume costs and assets increase at the same rate as sales. Also assume 40% of net income is paid out in dividends, the current debt to equity ratio is optimal, and that no new equity sales are possible. Forecast the addition to retained earnings assuming the firm's sales increase at the maximum percent possible given these assumptions.

Assume costs and assets increase at the same rate as sales. Also assume 40% of net income is paid out in dividends, the current debt to equity ratio is optimal, and that no new equity sales are possible. Forecast the addition to retained earnings assuming the firm's sales increase at the maximum percent possible given these assumptions.

A) $43.2

B) $88.5

C) $113.3

D) $146.7

E) $167.8

Correct Answer:

Verified

Q72: The following balance sheet and income statement

Q73: The following balance sheet and income statement

Q74: Q75: The following balance sheet and income statement Q76: Q78: Silver's Jewelers has current sales of $138,900 Q79: Calculate the external financing needed given the Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()