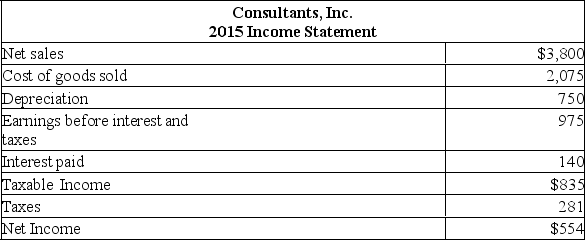

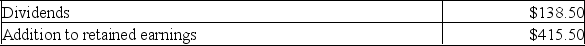

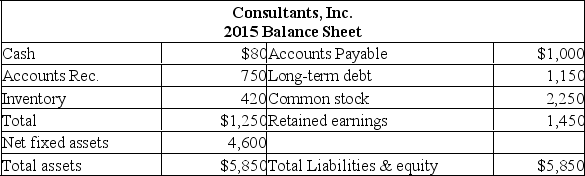

Consultants, Inc. is currently operating at full capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 5%. What is the external financing needed?

Consultants, Inc. is currently operating at full capacity. The profit margin and the dividend payout ratio are constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 5%. What is the external financing needed?

A) -$293.78

B) -$193.78

C) $122.50

D) $292.50

E) $367.27

Correct Answer:

Verified

Q65: Given the following information, calculate sales value.

Q66: Baker's Dozen has current sales of $1,400

Q67: Assuming that a company has a policy

Q68: Calculate the projected fixed assets needed given

Q69: Q71: Calculate sales given the following data. Total Q72: The following balance sheet and income statement Q73: The following balance sheet and income statement![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents