Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of capacity, what is the external financing needed (EFN) for 2018 ($ in millions) ?

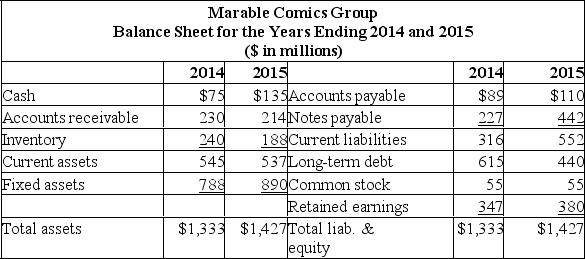

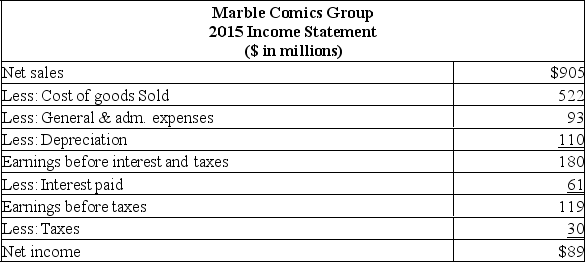

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of capacity, what is the external financing needed (EFN) for 2018 ($ in millions) ?

A) EFN is negative

B) $21.94

C) $48.31

D) $76.32

E) $89.85

Correct Answer:

Verified

Q119: Q120: Calculate the external financing needed given the Q121: Q122: The following balance sheet and income statement Q123: Suppose a firm has net income of Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()