Multiple Choice

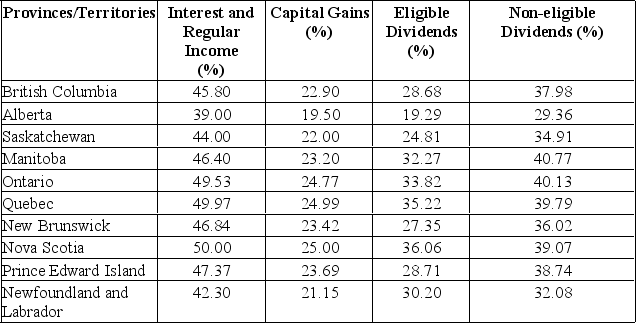

A Quebec resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $8,493

B) $9,493

C) $10,493

D) $11,493

E) $12,493

Correct Answer:

Verified

Related Questions

Q48: Q49: An Alberta resident earned $30,000 in Q50: Q51: A $40,000 asset was purchased and classified Q52: BassiCorporation had a beginning and ending fixed Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()