Multiple Choice

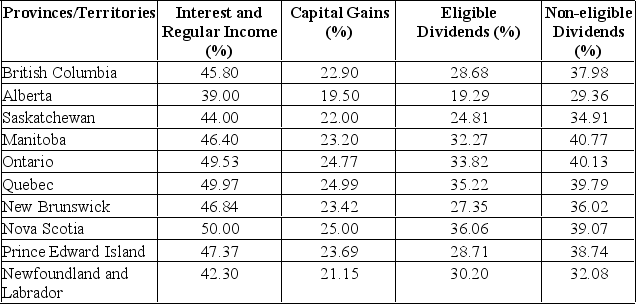

A New Brunswick resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $12,710

B) $11,710

C) $10,710

D) $9,710

E) $8,710

Correct Answer:

Verified

Related Questions

Q41: A Nova Scotia resident earned $20,000

Q42: Q43: Q44: Given the following statement of financial position Q45: A Prince Edward Island resident earned![]()

![]()