Multiple Choice

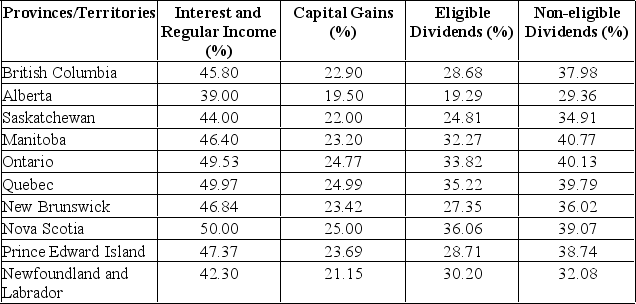

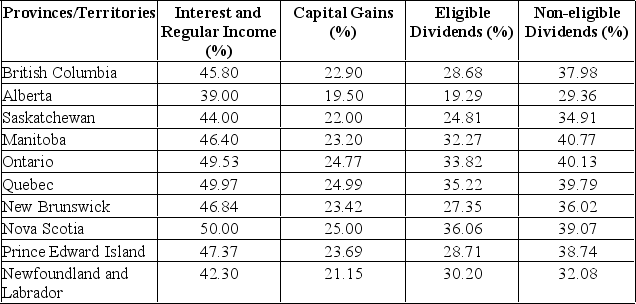

A Prince Edward Island resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

Correct Answer:

Verified

Related Questions

A Prince Edward Island resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

Correct Answer:

Verified