Multiple Choice

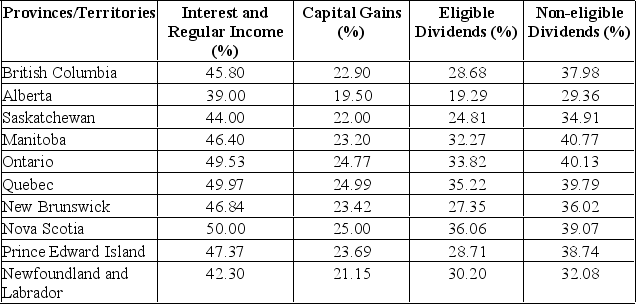

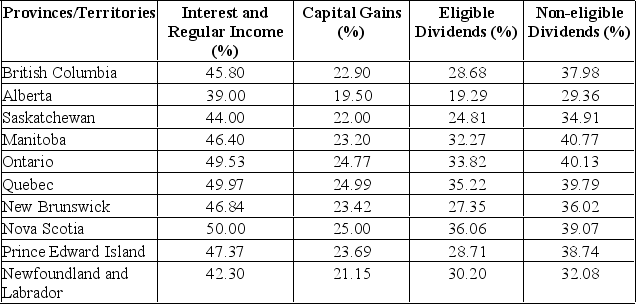

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

Correct Answer:

Verified

Related Questions

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

Correct Answer:

Verified