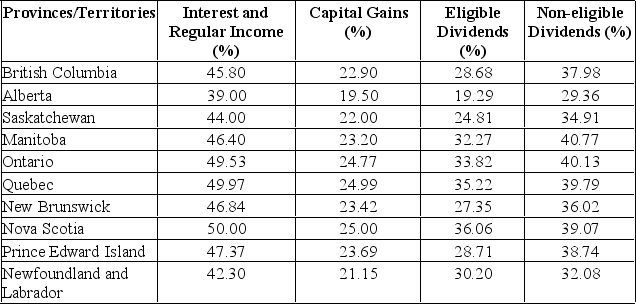

An Alberta resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the total tax paid.

A) $29,125

B) $28,975

C) $27,174

D) $26,895

E) $26,204

Correct Answer:

Verified

Q90: Based on the following information, calculate stockholders'

Q91: Jack's Shoes has net income of $19,600

Q92: Ice Corporation has purchased a Class 10

Q93: Suppose that a firm paid dividends of

Q94: During the year, a firm paid $25,000

Q96: Brandy's Candies paid $23 million in dividends

Q97: Q98: Six years ago, Thompson Distributors purchased a Q99: A firm has current assets of $400, Q100: ![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents