Multiple Choice

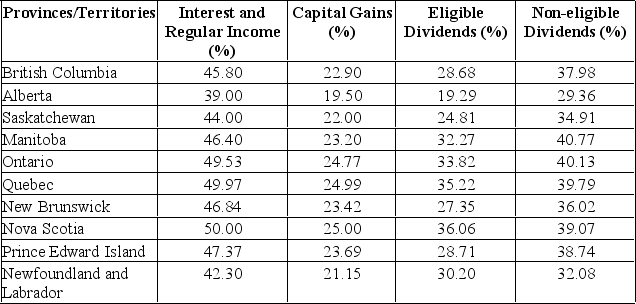

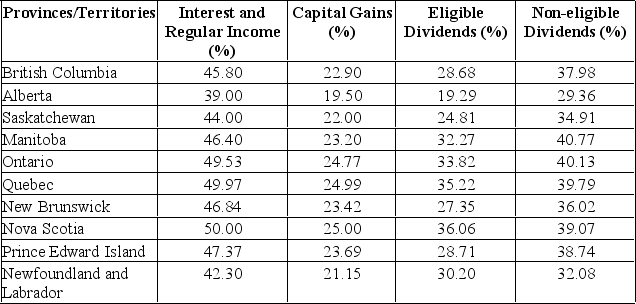

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the average tax rate.

A) 28.46%

B) 28.97%

C) 30.36%

D) 30.97%

E) 31.46%

Correct Answer:

Verified

Related Questions

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the average tax rate.

A) 28.46%

B) 28.97%

C) 30.36%

D) 30.97%

E) 31.46%

Correct Answer:

Verified