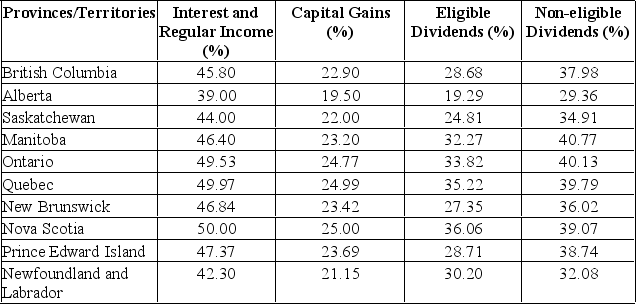

Calculate the tax difference between a British Columbia resident and an Ontario resident both having $20,000 in interest income and $25,000 in capital gains.

A) British Columbia resident would pay $1,213.50 more than the Ontario resident.

B) British Columbia resident would pay $1,213.50 less than the Ontario resident.

C) British Columbia resident would pay $1,456.50 more than the Ontario resident.

D) British Columbia resident would pay $1,456.50 less than the Ontario resident.

E) There are no tax differences between the two tax payers.

Correct Answer:

Verified

Q242: The rationale for examining financial statements is

Q243: If operating cash flow is negative, then

Q244: Which of the following accurately describes the

Q245: Calculate the tax difference between a

Q246: Free cash flow is commonly referred to

Q248: If the market value of an asset

Q249: Which one of the following is a

Q250: Under GAAP, statement of financial position, assets

Q251: Cash flow from assets is equal to

Q252: Calculate the tax difference between a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents